The project studies innovation of firms under global and localised competition for market shares. It employs an evolutionary learning mechanism with a ‘winner takes all/most’ market structure (‘replicator dynamics’).

We build on a model by Dosi et al. (2017) to examine the effect for deviations in market structure from global competition. For that purpose, our model features a network structure of localised competition between firms selling similar products. This makes it possible to disentangle the effects of two modes of competition: the global competition for sales and the localised competition for market power.

Many firm-level variables follow distributional regularities or ‘scaling laws’. Among the most prominent are Zipf's law describing the largest firms' extremely concentrated size distribution and the robustly fat-tailed nature of firm size growth rates, indicating a high frequency of extreme growth events.

Try it yourself!

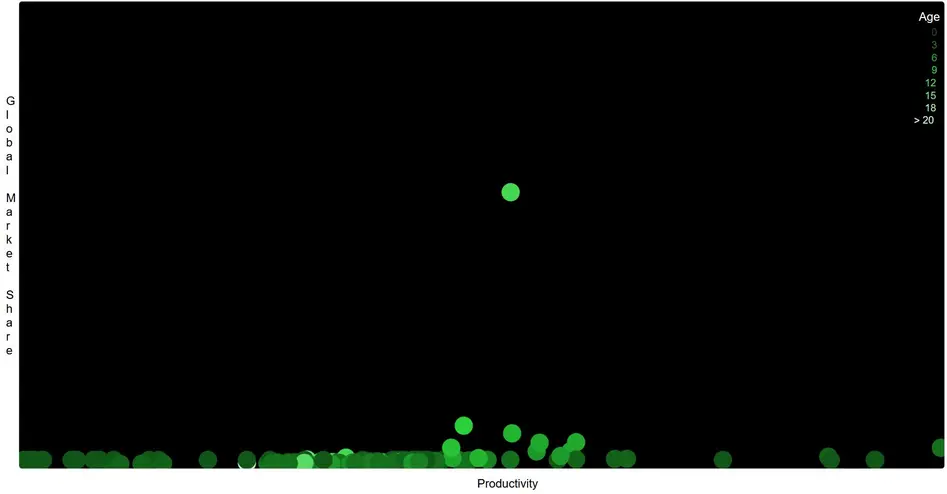

Click here or the picture below and get to the model. Set the intensity of localised competition yourself: 1 means that each firm directly competes with each other firm and 0.01 represent co-existing local monopolies for any product in the industry.

To reproduce empirical findings, you should aim for few firms with high growth rates and high but not the most extreme market concentration. If you are concerned with equality in market power as an outcome, you should try ‘regulating’ the market in a way that minimises concentration in market share. If you believe in equality of opportunity for entering firms, do not obstruct localised competition in any way.

Key findings

Simulation results suggest that the empirically well-established combination of fat-tailed, ‘superstar-like’ firm growth rates and Zipf tail, describing the largest firms' extremely concentrated size distribution, is consistent only with a knife-edge scenario in the neighbourhood of most intensive local competition.

Any lower level of localised competition leads to significant deviations from the stylised facts in at least one regard. Hence, given empirically well-established replicator dynamics, our results point to product markets that are relatively undifferentiated. Thus, market power comes from global rather than localised dynamics. This indicates that anecdotal insights gained from analysing static frameworks of competition do not necessarily transfer well to situations where strong non-linearities and feedback mechanisms are present.

Furthermore, the simulation results contest the conventional wisdom derived from a general equilibrium setting that maximum competition leads to minimum concentration of revenue. In contrast to that, we find that most intensive local competition leads to the highest concentration, whilst the lowest concentration appears for a mild degree of (local) oligopoly.

Since inequalities of initial productivity shrink with increasing network density and do not exist for the complete network, a lower level of competitiveness implies lower market concentration: The absence of inequality in starting conditions leads to the most successful firms acquiring a greater market share. Consequently, one must accept the success of these superstars as an outcome if the aim is to create full equality of opportunity; otherwise, to avoid high market concentration by the most successful firms, one must deliberately create inequality of opportunity.

Besides these global findings, the model also suggests that there are localised cycles of productivity and firm size: If incumbents have acquired high localised market power and a high productivity level, new entrants joining the market segment and engaging in competitive interaction (i.e., linking to the productive incumbents) also start with a high productivity rate. This means that the industry in question becomes even more productive until it overheats, and incumbents are repressed from the market while the high productivity shifts to another (possibly new), related market segment. Moreover, our model supports their finding that there is a first-follower advantage (in our model represented by successful entrants).

These outcomes emerge because in each simulation period, the firms improve their productivity by idiosyncratic stochastic learning, while new entrants adopt the specific productivity level of their sub-market (i.e. the productivity of their immediate competitors weighted by localised market power). Thus, the model suggests that new firms are most successful if they join existing, highly productive submarkets. Accordingly, while accepting bounds on rationality, we can single out the strategy which a perfectly rational market entrant would pick when faced with a certain market structure.